|

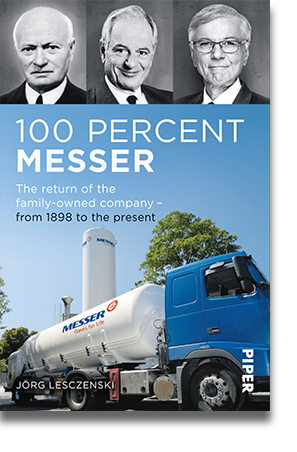

For 125 years, the name "Messer" has been associated with expertise in the field of industrial gases as well as welding and cutting technology. At the same time, the brand name also stands for the close connection and eventful history between the company and the family.

|

The story of Messer

Extracts of the book "100 per cent Messer"

Adolf Messer's first steps into international markets

Adolf Messer was born on 6 April 1878 in Hofheim/Taunus, the son of Johann Matthäus and Margarethe Messer. In 1898, aged 20 and still a mechanical engineering student, he set up a small workshop, which quickly led to his first successes with the construction of acetylene generators and lighting appliances. Even at this very early stage, Messer was looking beyond the German market. In the first seven years following the founding of the company, approximately 300 installations were exported.

Since acetylene lighting installations were increasingly suffering from the competition from gas lights and electrically powered lighting systems and, moreover, the demand for acetylene for cooking and heating was decreasing, Adolf Messer was quickly forced to change his product range: he took up autogenous welding and exported his first air separation units before the First World War. The expansion of the company was reflected above all in the establishment of branches and subsidiaries both at home and abroad, which became an important mainstay of the company. The outbreak of World War One in 1914 put a temporary stop to the company’s international expansion. After 1918, in the difficult economic conditions of the post-war era, Adolf Messer put a lot of energy into regaining the export markets after the company assets in Great Britain and the USA had been seized and auctioned off. In the 1920s, the company once again built up its contacts with foreign customers and consolidated its domestic market position in the cutting and welding sector, since the production facilities had survived the First World War almost unscathed.

Even though Messer succeeded in continuously diversifying and modernising its product range, the company was not spared the effects of the Great Depression of 1929 to 1932/33. The global economic collapse led to a dramatic crash in industrial production. Sharply declining sales and job losses also characterised Messer’s day-to-day business from the late 1920s onward.

After the collapse of the Weimar Republic in 1933, the Frankfurt-based company was operating in a macroeconomic environment that was increasingly recovering from the severe economic crisis. German industry had already come through the worst of the recession by the spring of 1933, from which point it benefited from the global economic upturn as well as the armaments and employment programmes pushed through by the NS regime. At Messer & Co. GmbH, as at other companies, the day-to-day business was increasingly overshadowed by the forced military build-up, resulting in, for example, several orders from the German Army Ordnance Department for the construction of special machinery. Thus, electrical welding equipment from Messer was used for joining tank walls, for improving resistance welding technology in order to achieve gas-tight seals on pressure hulls and hollow bodies, or for developing the Nivosec curved-space oxygen cutting machine, which made it possible to carry out three-dimensional work on pressed armoured cupolas for armoured vehicles. The company was also involved in the research into the construction of missiles, which the army tested from 1936, and delivered four large-scale installations for the production of liquid oxygen to the army testing facility at Peenemünde. With the advance of the Allies in the final weeks of the war, all of Messer’s production facilities gradually came to a standstill in the spring of 1945. The three years or so between the end of the war on 8 May 1945 and the currency reform were characterised by improvisation in every area. In terms of the company’s development in the post-war period, it was an invaluable advantage that relations with long-standing foreign business partners could be quickly re-established on a basis of mutual trust in spite of the devastation caused by the NS state’s aggressive foreign policy. In April 1946, for example, Adolf Messer had invited Raoul Amédéo to visit, followed shortly afterwards by his sons Pierre and Jean, in order to revive their collaboration through the formation of the Société Française des Appareils et Procédés Messer. Before Adolf Messer succumbed to a serious illness on 13 May 1954, he had ensured that the company would remain in family ownership: one year before his death at the age of 74, he had decided to transfer the responsibility for the overall running of the company to his son, Hans.

On the way to a global enterprise - the era Hans Messer (1953 - 1993)

With the still young Hans Messer at the helm of the company, who had succeeded his father, Adolf, as Managing Director at the age of 28, Adolf Messer GmbH shared in the economic boom of the 1950s.

Messer’s growth in the early years of the Federal Republic was not, however, solely due to the business it conducted with the key industries of the “economic miracle” (iron and steel and shipbuilding industries etc.), but also to the formation of numerous subsidiaries and joint ventures abroad. After the company’s growth hit internal limits in the early 1960s, Adolf Messer GmbH merged with parts of Knapsack-Griesheim AG, which was part of the Hoechst AG group of companies, to form Messer Griesheim GmbH in 1965.

The merger meant a certain loss of corporate power for the family, at least on paper, since the ownership structure of the company had fundamentally changed: 66 2/3 per cent of the initial share capital of 30 million deutschmarks was now held by Hoechst while 33 1/3 per cent was held by the Messer family through Messer Industrie GmbH.

Although the merged company started life as part of a large corporate group, the family was able to secure its long-term influence on the history of Messer Griesheim through the basic agreement between Hans Messer and Hoechst AG. As agreed beforehand between Hans Messer and Karl Winnacker, the permanent presence of the family on the executive committees was laid down. The executive board was to consist of “at least three, and no more than four people. The Messer family is entitled to nominate one executive director, as long as its stake does not fall below ten per cent, while Hoechst is entitled to nominate two executive directors.” It goes on to say: “Each party will comply with the nomination of the other party for the appointment of the executive directors unless there is an important reason that stands in the way of a particular appointment.”

Maintaining influence

Hans Messer was appointed as the first CEO, “if he himself wishes this”. Moreover, both parties agreed to constitute a shareholders’ committee, “on which Hoechst and the Messer family will each have two members” and which “is supposed to be authorised to give instructions, in particular with regard to the executive board”. Finally, the agreement in principle stipulated company policy decisions which require “a 75 per cent majority”. These included a “change in the purpose of the company”, the “taking out of larger loans” or the “appointment and dismissal of executive directors”. There were also various agreements within the family to ensure that the family’s influence on the operational business was not put at risk. For example, Hans and Ria Messer decided to sign an agreement with their children which obligated every family member only to exercise their voting rights collectively in future. The agreement of June 29, 1979, which designated Hans Messer as the person with the casting vote, was also supported by the family of Erika Heberer (daughter of first marriage of the company founder Adolf Messer) as well as the Adolf Messer Foundation. In short: despite a shareholding of “only” around 33 per cent, the family definitely exerted a 100 per cent influence on company policy.

New applications

In the second decade after its formation, it quickly became clear that Messer Griesheim GmbH had been successful in forming potential synergies which were now exploited to the full. In the wake of a general economic recovery phase lasting several years, there was continuous growth in worldwide sales after 1975, passing the magic figure of one billion deutschmarks for the first time in 1978, and reaching over 1.7 billion deutschmarks, almost double what it had been ten years before, in 1984, which was Messer Griesheim’s most successful financial year up to that point. The industrial gases business remained the real engine of growth, accounting for around 70 per cent of total turnover between 1975 and 1989. The company particularly benefited from the fact that, in addition to its traditional customers in the steel, shipbuilding, automotive and chemical industries, it also succeeded in developing new applications for compressed and liquefied gases, gas mixtures and speciality gases thanks to intensive research work, leading to business partnerships in new growth sectors.

After the rusting away of the “Iron Curtain” in Eastern Europe, Messer Griesheim was also able to take advantage of the new opportunities opening up in the emerging markets of the former Socialist countries, before an era in the history of Messer Griesheim came to an end in the spring of 1993. After 40 years of service as CEO, Hans Messer retired from the company’s operational business at the age of 68, in accordance with the agreement with Hoechst AG. However, the company continued to benefit from his experience and expertise in different capacities as he served on the Shareholders’ Committee and the Supervisory Board until his death in 1997.

Crisis, turbulence, change - from a global player to "100 per cent Messer" (1993 - 2004/5)

Following Hans Messer’s retirement from senior management, both the long-standing harmonious arrangement between Messer Industrie GmbH and Hoechst AG and the family’s position in the company came under severe threat from several directions as the 1990s progressed.

In 1993, Hans Messer passed the responsibility for running the company to Herbert Rudolf, a family outsider who had a good track record in managing Messer’s USA subsidiary.

Under Herbert Rudolf’s leadership, Messer Griesheim embarked on an aggressive course of globalization which was ultimately to end in failure. The numerous and, in some cases, highly speculative acquisitions and start-ups of foreign companies and subsidiaries led to a massive deficit which, just before the millennium, would provoke the dismissal of Herbert Rudolf and a sharp correction in the company’s overall policy. But that wasn’t all: following Hans Messer’s departure, practices that had long been regarded as fundamental in the development of the company were now called into question by the new man in charge. It was Herbert Rudolf’s clear intention to eradicate family influence on the running of the company altogether.

Debts and passiveness

During the 1990s, the business policies of Messer Griesheim became closely linked to the strategic goals of the Hoechst Group. From 1994 onwards, Hoechst’s prime focus was on their core businesses of pharmaceuticals, agrochemicals and industrial chemicals and they were now keen to divest themselves of their two-thirds majority share in Messer Griesheim. There followed many years of debate about the future ownership structure of the Messer Griesheim Group and a remarkably passive attitude on the part of the Hoechst board towards the spiralling Messer deficit. Early warnings emanating from the Messer family about the imminent collapse of the company were brushed aside and Herbert Rudolf was given virtual carte blanche.

After the stock market flotation failed and the much touted sale to Linde AG fell through at the last minute because of complications arising from anti-trust legislation, the Hoechst/Aventis shares in Messer Griesheim were finally transferred to the financial investment companies Goldman Sachs and Allianz Capital Partners in April 2001. They also took on two thirds of the net deficit which by spring 2001 had reached the not inconsiderable figure of 1.72 billion euros.

Resignation and investment

However, disputes within the family were also endangering the continued existence of the company. For example, Thomas Messer, the eldest son of Hans Messer, declined to take “any further responsibility for the maintenance and development of the family business” as he wished to chart his own future. In December 1996, Thomas Messer resigned from Messer Industrie GmbH and gave away the greater part of his MIG shares to the charitable Adolf Messer Foundation.

When, in the second half of the 1990s, the fate of Messer Griesheim was hanging in the balance, Stefan Messer – second son of Hans Messer, who died in 1997 – made his view quite clear that the family should retain their long-term influence over the company. In 1999, he purchased the Messer Cutting & Welding subsidiary from Messer Griesheim GmbH on behalf of the family.

One year later, under the direction of American financial investors Carlyle, the company’s Cutting and Welding division merged with the Swiss company Castolin Eutectic to form the Messer Eutectic Castolin Group – a new company with the Messer family holding 36 per cent of the shares.

Restructuring and a new beginning

At Messer Griesheim, where control of the far bigger industrial gases side of the business still lay, the financial investors’ prime focus after 2000 was on restructuring and debt relief. Messer Griesheim divested itself of a number of its holdings, concentrated on certain core regions and successfully completed its “slimming down” process. When discussions about the future of Messer resurfaced after autumn 2003, one section of the family led by Stefan Messer resolved to take responsibility for the company back into their own hands (much to the surprise of the financial investors). They withdrew from operations in Germany, the USA and the UK and acquired the shares held by Goldman Sachs and Allianz Capital Partners.

Since May 2004, the former Messer Griesheim Group has once again become an family-run industrial gases company operating under the name of Messer Group GmbH. Finally, in early 2005, Stefan Messer also bought out financial investor Carlyle’s holding in the Messer Eutectic Castolin Group, thus restoring to family control what his grandfather Adolf Messer had founded more than a century earlier and what his father Hans Messer had built up after the Second World War – a company with a global reach operating in the industrial gases and cutting & welding technology sectors.

From the return of the family to the financial and economic crisis (2004/5 - 2010)

It soon became clear that the timing of the family’s return to the operational side of the business could hardly have been better: the reorganisation of the group, now much smaller in size, was greatly facilitated by a global economic boom lasting several years. The company’s revised policy centred on two strategic objectives: over the next three or four years, the “Independence” project was implemented in order to restore an independent product supply as far as possible. In addition, Messer significantly expanded its presence in Chinese markets with their spectacular annual growth rates. Initially, this involved the construction of air separation units for steel companies, but over time the customer base became increasingly diversified to include the food, chemical and electronics industries.

Return to the German market

There was also another objective at the top of the management’s list of priorities. Messer wanted to get back into the German market. Since no gases could be sold in Germany under the brand name Messer until 2008, Stefan Messer set up Gase.de Vertriebs-GmbH with its headquarters in Sulzbach. From 6 May 2007, a workforce of 35 set about supplying gases in cylinders and tanks to customers such as metal-processing companies and food manufacturers. In November 2007, Gase.de Vertriebs-GmbH pulled off a remarkable coup in gaining Deutsche Edelstahlwerke as its first major customer.

The big moment came twelve months later. From the 7 May 2008, Messer Industriegase GmbH continued the work of Gase.de Vertriebs-GmbH in Germany. At the same time, Stefan Messer announced the company’s second major customer in Germany. The new Messer company invested 50 million euros to supply Salzgitter Flachstahl GmbH and its subsidiary Peiner steelworks with oxygen via a pipeline system for at least 15 years. The new Messer subsidiary could be proud of what it had achieved in the first year. Messer Industriegase GmbH had two key accounts on board and had acquired over 150 new cylinder gas customers since May.

Crisis years?

With strong global economic growth having played into Messer’s hands for around four years, the wind shifted in the autumn of 2008. Unbridled expansive monetary policy, reckless lending and failings in the regulation of the financial markets led to the real estate bubble bursting in the USA. A massive loss of confidence on financial markets and a paralysis affecting the flow of money between banks plunged the global economy into deep crisis in late summer.

Messer didn’t escape the financial and economic crisis either, the effects of which varied quite widely from region to region. The group experienced a particularly difficult year in Central Europe, the Ukraine, the Baltic States and Southeast Europe. By contrast, business was better than expected in Western Europe, where Messer benefited from its broad customer base. In addition, the Group’s expansion in the German market was a particular factor in achieving a reasonable result in Western Europe. In 2009, an even more important factor was the company’s strong presence and economic success in China. Messer profited considerably from a new joint venture with steel producer Panzhihua Iron & Steel, part of the Pangang Group (Sichuan Pangang Messer Gas Products Co. Ltd.). With the launch of the joint venture, Messer was able to generate sales on a considerable scale starting from 1 September 2009, which had a positive effect on the Group’s overall performance (a slight increase in sales of 0.2 per cent to approximately 797 million euros).

The world economy recovered from the shock of the recession more quickly than expected. Little by little, Messer also emerged from the financial and economic crisis. Messer continued to consolidate its good market position in China and began construction of its on-site facility in Vietnam. The upturn in Western Europe was facilitated by a positive business climate in Italy, Spain and especially Germany. By contrast, patience was called for in the Southeast European markets, where results had not yet recovered to 2008 levels.

In the midst of the global economic crisis, Stefan Messer had to go through his most difficult personal ordeal to date. The devastating diagnosis of “tongue cancer” in 2008, the search for appropriate therapies and a number of relapses hit him hard. A complicated operation was followed by several months of convalescence and a gradual return to work. Divorces – even in the manner of the “Wars of the Roses” – are one of the risks involved in the effective running of a family business. In 2012 Stefan and Petra Messer divorced – though without any impact on the family business. In January 2015, Stefan Messer married his second wife Jenjira Najaroen, and before long there were additions to the family. On 12 May 2016, his wife gave birth to twins.

Troubled times - and a new era (2011 - 2020)

Whilst the turbulence in the financial markets and the real economy had abated and Messer even achieved sales of just over a billion euros for the first time in 2011, there was a growing feeling among the management that they were going about their daily business in times marked by upheaval and change. A troubled economic environment, the euro and national debt crisis, international political crises (“Crimea crisis” etc.), but also social megatrends such as demographic changes (a rising world population, increasing urbanisation etc.), the scarcity of important resources such as water and energy, climate change, new technologies (digitalisation) as well as the trend towards a global knowledge society henceforth had to be considered as crucial factors in the planning process. From April 2011, Messer tackled the ongoing and numerous new challenges from its new company headquarters in Bad Soden.

Gains in Asia, moderate growth in Europe

In terms of investment policy, there was a significant ongoing trend following the financial and economic crisis. Business operations in Asia continued to gain in importance for Messer. In China, the Group entered into new partnerships beyond the steel industry and also upped its investment in member states of the Southeast Asian ASEAN group. One country particularly regarded as a “rising star” was Vietnam, where Messer’s long-term cooperation with steel producer Hoa Phat was further expanded. Messer ventured into new territory in other ASEAN states. The management saw good growth potential in Malaysia in particular. Messer also made its first moves in Thailand, establishing a sales company.

Although, in Western Europe, efforts were focused on core markets, the strategy of pursuing niche markets has yielded only moderate growth of one or two per cent in the past few years. Significant growth has also been difficult to achieve in Eastern and Southeast Europe in recent years. Messer has remained in a strong position, investing in the construction of new production facilities and, in many cases in Southeast Europe, enjoying the status of market leader with high profitability. The problem is that the markets are small, though the Messer Group has achieved remarkable successes in Poland and Hungary.

A new era

Following the announcement of a proposed merger by the two industry giants Linde AG and Praxair Inc. and the competent anti-trust authorities’ judgement that a merger would be conditional on both corporations disposing of considerable parts of their business, there has been a lot of activity in the industrial gases sector recently, with Messer’s market position also facing considerable changes. Given that growth by one’s own efforts is scarcely possible any more, and with the trend suggesting that significant increases in global market share are only achievable by means of acquisitions, the management decided to enter the talks with Linde and Praxair. In March 2019, Messer Industries GmbH – a newly established joint venture between Messer and financial investor CVC Capital Partners – acquired 44 air separation units, among other things, from Linde/Praxair in the USA, Canada, Colombia, Brazil and Chile. All told, the Group’s volume of business did almost double on 1 March 2019.

The fourth generation

As far as Stefan Messer is concerned, the Group will remain a family enterprise in the future. The family is currently in the process of slowly preparing to put succession arrangements in place and pass on responsibility for running the business to the fourth generation. His son Marcel, born in 1988, studied business management at the European Business School in London, then worked for investment company BlackRock Inc. and recently decided to continue his career at Messer. Since May 2018, he has been getting to know the gases business from the ground up. Stefan Messer’s daughter Maureen (born 1984) studied languages and education at the University of the West of England in Bristol, after which she worked as an English teacher in Paris. Her husband, Cédric Casamayou, now also works for the Group in the Finance Department.

Dr Jörg Lesczenski, author of “100 per cent Messer”